Digital asset developers, as well as resellers and online shopping sites can make good money on trading digital assets.

Digital assets include almost any digital content: crypto-currency tokens listed on stock exchanges, training videos or audio courses, e-books, various manuals, images, databases, photographs, card details for topping up accounts, access codes, software, website templates, marketing swipe files, and so on. Any digital asset can be sold or bought.

There are many online platforms for trading digital assets (we are not going to advertise them). On the contrary, let’s discuss the common downsides of existing online platforms dealing with digital assets. What happens is that the existing trading platforms usually do not apply blockchain technology. Otherwise, most of the shortcomings would have been eliminated.

Before we get into how blockchain is the best solution for trading digital assets, let’s first take a look at digital asset trading in action.

Digital Asset Trading Process

From the buyer’s point of view, digital asset acquisition is mostly reduced to completing the necessary payment procedures and receiving one or several files with the content purchased. In general, that is where it ends. Of course, sometimes the buyer may be subject to fraud, for example, if the content received comes short of the declared content. We will not delve into these intricacies for now.

From the seller’s point of view, digital asset trading is more complicated.

The seller placing digital assets on an online trading platform actually grants this platform easy access to his content. In this case, the marketplace can basically manage this content at its will. In fact, nothing prevents the marketplace from transferring this content to third parties. It is quite difficult to prevent it from selling these digital assets on its own without paying the original seller who posted this content in the first place.

Frequently the trading platforms’ bad faith and unfair practice are not that critical. These problems can be solved by choosing the most reliable and reputable trading platform. If a marketplace values its reputation, it will operate with maximum good faith.

However, regardless of the trading platform’s fairness level, sometimes one has to ensure that only the buyer is granted access to the content being sold, and no one else. If the marketplace should not have access to the content being sold, the mechanism described above is not suitable.

When only one buyer is to receive the digital asset purchased, the deal should be done bypassing the intermediary trading platform. Given this approach, the marketplace only connects the buyer and seller, but does not possess the digital content required. Thus, the buyer receives the content, but the marketplace does not. This is another method differing from the previous example.

However, even when the marketplace only establishes contact between the seller and the buyer, there is no guarantee that the content will not become available to third parties. For example, the seller sends files by e-mail, so the content is available to the e-mail provider, not just the buyer. If the seller encrypts the files, he needs to provide the password which can be intercepted along the way.

Technologies allowing the content to be transmitted in such a way making it impossible to be intercepted during transmission have long been available. For example, PGP-encryption allows to encrypt files for the specific recipient’s e-mail; no one else can decrypt this message. Even the traditional https protocol also does the trick (although the seller has to provide a server for the client to download files). Modern instant messengers using end-to-end encryption are an option as well. In general, digital content can be transferred directly, but the seller and the buyer have to agree first on the method used; reaching this agreement can prove to be difficult.

The problems do not end there. The marketplace only connects the seller and the buyer, but it cannot provide a reliable record of the digital content transfer. That is, both the seller and the buyer have room for fraud. For example, having received the asset the buyer may declare that he has received nothing. On the other hand, a dishonest seller may claim that the digital assets have been sent, but in fact he did not send anything at all or sent something completely different.

If the fraud has actually taken place, how will the platform handle this problem? After all, payments are carried out via the marketplace which receives a commission. Will the money be refunded to an unfair buyer claiming he did not receive the assets he paid for? Should the money be transferred to a dishonest seller who sends content different from the declared version? There is no definite answer to these questions. If the content transfer has not been documented by a verifiable witness, then it is impossible to avoid intentional fraud.

Thus, in order to implement full-fledged digital asset trade transactions it must be carried out by a verifiable witness. Transactions must somehow be recorded, and this information must be objectively verifiable — at least in the event of a dispute.

Technically, objective evidence can be implemented by blockchain technologies. The purpose of blockchain technologies is providing an objective and undeniable record of various transactions. Thus, blockchain-based digital assets trading seems to make sense at the very least.

Blockchain-based Trading

Let’s delve into blockchain’s role in trading digital assets, and understand the fundamental difference between blockchain-based and traditional trading platforms.

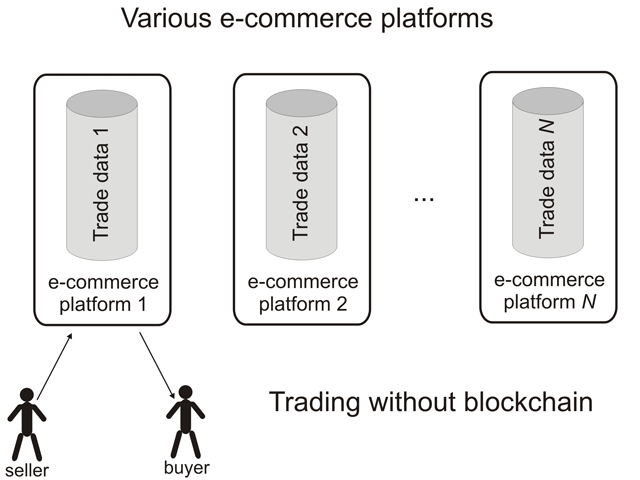

In the traditional digital trading model as discussed above, each trading platform operates its own database storing all the sellers’ data. It includes all pertinent information about the seller’s products, and, if required, the buyers’ data. Of course, this information is closed to outsiders. Other trading platforms are their competitors and have their own databases that do not interact with each other.

Given this approach, all trading takes place within the framework of each specific e-commerce platform. The picture below explains this:

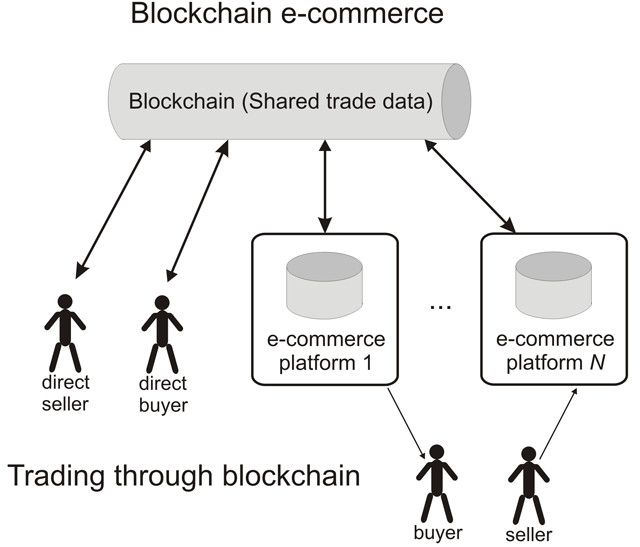

As opposed to this scheme, blockchain-based trading is entirely different: in fact, blockchain represents shared trade data fully operable from anywhere in the world. Subsequently, any blockchain-based e-commerce platform operates this shared data. Moreover, nothing prevents sellers and buyers from using this data directly without using intermediary sites. The scheme explains:

Decentralization

Blockchain-based trading centers around decentralization. Sellers and buyers have the opportunity to choose the most convenient platform for transactions. They can use intermediary sites providing user-friendly functions and interface for operating shared trading data. They can work directly through blockchain based on the “one’s own e-commerce platform” principle.

Such a decentralized approach is much more resilient compared to centralized trading platforms. In this case, if the frequently-used trading intermediary site ceases to work, the client can switch to another site and manage the same digital assets.

If the seller or buyer require anonymity, transactions can be made directly through blockchain without any intermediary sites. In this case, it is almost impossible to track the client’s location.

Why don’t all clients trade directly without intermediary websites? Intermediary sites can actually provide useful additional functionality, for example, presenting digital assets in catalogues facilitating search. Searching requires processing a lot of data, not every mobile device can cope with such volumes. This is where intermediary sites step in.

Also, intermediary sites can have a rating system, reviews, sellers’ and buyers’ reputations which may be of practical interest to customers.

Thus, the e-commerce intermediary sites niche remains intact by the advent of blockchain-based trading. In general, sellers and buyers will continue to work through intermediary websites paying a small commission for additional services, rather than making transactions directly through blockchains.

Anonymity

As discussed above, nothing prevents sellers and buyers from increasing their anonymity level when trading via blockchains. This feature may not be received with open arms since anonymity increases the likelihood of criminal acts. However, blockchain-based trading does not provide any new anonymity opportunities previously unavailable to criminal sellers and buyers. Blockchain-based solutions achieve a higher anonymity level in simpler terms compared to other methods. However, this technology does not open any new horizons.

Integrated Cryptocurrency Payments

A significant blockchain-based trading advantage is integrated cryptocurrecny payments. Of course, this in no way prevents using other payment systems on intermediary sites providing convenient access to blockchain-based trading, but the mere existence of an internal cryptocurrency payment system significantly facilitates many things as follows:

First of all, as you know, today many different currencies coexist in the world, different payment systems work with different currencies. However, it is desirable for an international trading platform to indicate prices in one currency so that this price can be expressed in other currencies at the current exchange rate. But the question is — what is the uniform currency for an international trading platform? U.S. dollar? Euro? Yuan? Any choice will entail the question «Why was this currency chosen?» and some people will consider it unjust that they have to use a currency other than their national one. Cryptocurrency payments can eliminate these problems. The question of price currency is solved and no national currency is given priority.

Besides, cryptocurrency payments are independent of a banking system, and this proves to be a very useful feature. A traditional bank can collapse with all its clients’ accounts. Regular bank accounts may be blocked by supervisory authorities under some pretext. Crypto tokens are free from all these drawbacks, which is certainly an advantage.

Transaction Irrevocability

Cryptocurrency transaction’s irrevocability may seem a system flaw. However, this is hardly a disadvantage.

Experienced fraudsters are generally able to prevent money refund to the deceived owner, despite the fact that banking payment systems provide transactions revocation.

If transaction revocation rules are too strict, the fraudster usually manages to withdraw the stolen funds before the victim can do anything.

If the rules are too liberal, the buyer can receive the digital asset and then easily return the money canceling the transaction. This is completely unacceptable for full-fledged online digital asset trading. Irrevocable transactions adherent to cryptocurrencies are what the doctor ordered for the digital asset market.

All market players simply have to accept these “rules of the game” — that transactions are irrevocable — and build their business models in accordance with these rules.

Transaction Provability

The main advantage of blockchain-based trading is that all transactions are recorded in the blockchain, and this information is public.

Of course, sold digital assets will not become publicly available, the very content of digital assets is encrypted for specific buyers and cannot be decrypted without the corresponding password.

We are talking about recording transactions — digital asset purchase and sale. Digital content transfer becomes provable in the event of a dispute.

The buyer can no longer say “I have not received anything” when the fact of the digital content transfer has been recorded in the blockchain. The seller cannot say “I have not received payment” since the payment occurs as a cryptocurrency transaction in the blockchain.

Surely, blockchain records do not completely rule out the possibility of fraud, but at least it can make life very difficult for fraudsters. For example, if an unfair seller sends content that does not match the stated description, the buyer can argumentatively complain about the seller to reputation-based systems. Since the transaction is registered on blockchain, the buyer can provide the rating site with a password from digital content as proof — the site will be able to assess the legitimacy of the complaint and take appropriate actions against the seller (or the buyer, if the complaint was precarious).

Transaction Automatization

Since blockchain-based trading is implemented via smart contracts, payment and digital content transfer can be interconnected. Thus, as soon as the buyer transfers to the seller’s wallet the amount required, the system immediately sends the encrypted data for receiving the digital content to the buyer’s address.

Robin8 proposes to implement this functionality through an intermediate executory server which keeps track of the sellers’ and buyers’ account balances and implements other functionality missing from the existing Ethereum or Qtum block chain versions. In the future, with the advent of more functional implementations of blockchain technologies, all the necessary functions can be implemented at the smart contracts level, and content storage can be implemented at the blockchain level (in the current implementation, additional storage IPFS is used).

Integrated Feedback System

Since all transactions are recorded in the blockchain and the buyer’s address is publicly known, he can leave feedback about the acquired digital product. This feature is useful not only for automatic ranking of sellers and buyers, but also for cases when the same digital product is sold to multiple buyers.

Nothing prevents the blockchain-based implementation of selling assets to a single or multiple customers — the advantage being that transactions are recorded in the blockchain. Thus, buyer can easily see the content’s history.

If this digital product has already been sold, it is recorded in the blockchain, and the next buyer immediately sees it. If he is unhappy with the fact, he does not have to strike a deal. Otherwise, he can read reviews from previous buyers and make the transaction.

Current Implementation and Prospects

The Robin8 company has currently implemented a solution for online digital asset trading based on the Qtum and Ethereum blockchain. It is integrated into a Profile Management EcoSystem (PMES) that gives the user control of their data and allows it to be put Blockchain.

All advantages of the approach explained in this article will be available as part of PMES. To recap the main advantages, Robin8’s PMES is a better solution for trading digital data because it’s more secure, reduces fraud by the buyer or the seller, gives true asset owners a way to claim their data and sell it, and protects the digital asset from being used without permission. We have already identified and implemented the approach’s key technological aspects, and at this stage it is enough to proceed — to start developing blockchain-based trading platforms.

We see the development perspective in the application of powerful modern blockchain technologies which are currently emerging and beginning to be applied. We are also developing our own blockchain technology meeting the necessary requirements for blockchain-based trading.

We would like to make it clear that blockchain-based trading does not require any blockchain. Any technological blockchain platform can be applied. Several platforms can be used simultaneously as well to ensure blockchain-based trading.

Our successful developments in this field enable us to assert the promising outlooks for this technological approach. We believe that the future belongs to blockchain solutions in digital asset trading. The only question is when it will reach mass popularity.

About Robin8

Robin8 is the leading influencer search engine and marketplace. The company’s key technology is profiling, ranking and matching people down to a science and helping brands find the best people based on big data, AI and blockchain. Robin8 has already profiled over 30+ million people.

Robin8 recently launched its Profile Management EcoSystem (PMES) that allows any application to add their profile data on the blockchain.

To learn more, please visit www.robin8.com.

To keep up with Robin8, follow us on:

https://twitter.com/HelloRobin8

https://www.facebook.com/Robin8Inc/

Kakaotalk

https://open.kakao.com/o/gy58mkD

https://www.reddit.com/r/Robin8PUT/

Medium

Telegram